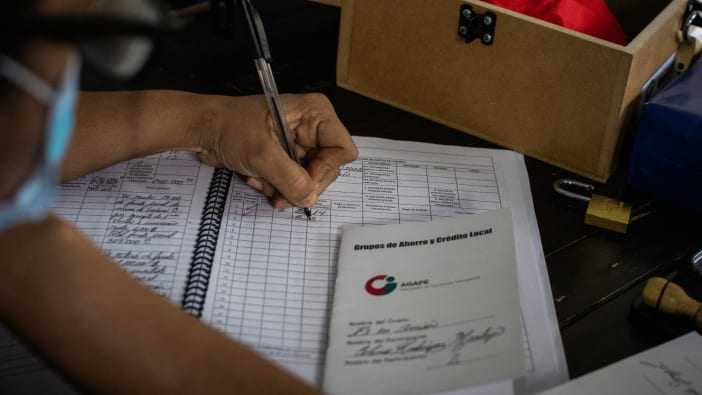

When dealing with money on behalf of others, accountability is crucial. The people given responsibility to manage the money need to be able to show that they are being good stewards of what is entrusted to them. It is important that they are protected from being tempted to use the money for their own purposes.

People given responsibility for a sum of money include staff in the finance department of an NGO, a church treasurer, a treasurer of a village development committee, credit and savings group or water committee, and so on. The most commonly used term is ‘treasurer’.

It is important that those who give responsibility to the treasurer set up accountability mechanisms. The treasurer is usually directly accountable to representatives of the group that holds the fund. This could be NGO leadership or church leaders. In turn, this group is accountable to the people who donated the money and the people who benefit from the initiatives it is spent on.

In many countries there are laws that encourage good financial accountability, but the laws are not always obeyed. With smaller amounts of money it can be easy for accountability to be ignored. Yet financial accountability mechanisms can be easy to set up. This article explores the principles of financial accountability and some practical steps that can be taken to ensure good financial management.

Key principles

- Planning

A budget is essential. A budget is a plan of how much income is expected during a given period of time (usually a year) and how the money will be used. Without a budget, the treasurer will not know how to spend the money. A budget shows how much the treasurer is allowed to spend and what it should be spent on. This budget should be agreed by representatives of the group. In an NGO or church, this could be the leadership team or governing body. In community groups, the budget may be agreed by all members of the group if the group is small.

- Recording

Accurate and complete records of all financial transactions are needed to show how money has been used. Financial transactions include income (money coming in), expenditure (money going out) and money that is loaned or borrowed. These should be recorded at the time of receipt or payment to avoid confusion later on. At the end of the year, financial transactions should match the amount budgeted, unless any changes have been approved by the wider group.

- Internal controls

These protect assets, protect treasurers, deter theft and help detect errors in the accounting records. One example is ensuring that financial administration tasks are carried out by more than one person to reduce error or fraud (intentional misuse of funds). Another example is having someone other than the treasurer check that the accounting records are regularly maintained and are added up correctly.

- Monitoring

Reports help others to monitor progress against budget. They are used by the treasurer to show that he or she has used the money well. Reports are used by the wider group to hold the treasurer accountable. Reports are also useful when raising money and reporting back to donors.

Key activities

- Where money is kept

Money and records of financial transactions should be kept in a secure place. Cash should be kept in a locked cupboard or safe and only a few named people should have access to the key. This protects the treasurer because the more people there are who can access the funds, the harder it is to keep track of them, or ensure accurate records.

All cash transactions should be recorded in a cash book so the treasurer knows how much cash is in the cash box at any one time. Cash that is not needed for immediate spending commitments should be taken to the bank as soon as possible and a receipt should be obtained. A bank account specifically for the fund should be set up. Keeping the money in someone’s personal bank account should be avoided.

- Transferring money

Supporting documentation should be produced for every transfer of money and should be kept in a secure place. This protects the treasurer as it means that he or she can produce evidence and details of transactions. Types of supporting documentation include invoices, receipts, an accounts book and bank statements. Receipts should be signed, stamped or produced on official stationery, showing the dates, value and type of transaction. An accounts book contains information about all the transfers of money that are made.

It is not easy to record income from the church offertory or voluntary cash donations. In these cases, the total income after a church service or fundraising day should be counted and documented. One or two people should be assigned to help the treasurer count the cash to confirm the amount collected. Each of those people should keep the others accountable to ensure that none of them steals any of the money.

A system should be set in place where payments need to be authorised by more than one person. This reduces the opportunity to commit fraud. For example, a bank account could be set up where two signatures are needed on cheques.

- Effective use of money

The treasurer should be provided with a budget that reflects the objectives of the group. Those who hold the treasurer accountable should check the accounts regularly, such as every month. If the treasurer overspends or spends the money on things that are not included in the budget, he or she can be held accountable. Likewise, questions could be asked if the treasurer spends less than budgeted as this could mean that the group’s objectives might not be met.

NGOs and churches with a large income should have their financial records audited every year by an independent accountant. The auditor checks all the records and will be able to identify any incomplete accounting or financial mismanagement.

Article compiled by Rachel Blackman.

A simple worksheet to record income and expenditure

This worksheet could be copied and used by a treasurer to record income and expenditure.

- A new worksheet could be used each month. At the beginning of a new month, use the first row to record the balance at the end of the last month. The balance is the amount in the fund.

- The ‘From’ and ‘To’ columns can be used to record who was involved in the transaction, such as who the donation was from or who the wages were paid to. This makes it easier to find the invoice or receipt.

- If the transaction involves money coming in, the amount should be entered in the ‘Income’ column. If the transaction involves money going out, the amount should be entered in the ‘Expenses’ column.

- At the end of every row, the balance should be stated. If the row records income, the amount should be added to the balance shown in the row above. If the row records expenditure, the amount should be subtracted from the balance shown in the row above.

Where the treasurer oversees a number of projects, a separate worksheet could be used for each project.

For larger or more complex funds, such as those that involve loans, more complex bookkeeping methods should be used and training should be provided for the treasurer.

| Day | Month | From | To | Description | Income | Expenses | Balance |

| 1 | 3 | Starting balance | 170.00 | ||||

| 4 | 3 | Congre-gation | Offertory | 50.00 | 220.00 | ||

| 10 | 3 | Smart Cars | Hire of mini-bus for youth camp | 20.00 | 200.00 | ||

| 10 | 3 | Fuel Station | Fuel for mini-bus | 10.00 | 190.00 | ||

| 11 | 3 | Congre-gation | Offertory | 33.00 | 223.00 | ||

| 13 | 3 | National electricity | Quarterly electricity bill | 30.00 | 193.00 | ||

| 18 | 3 | Congre-gation | Offertory | 70.00 | 263.00 | ||

| 21 | 3 | D & A Building Supplies | New church door | 15.00 | 248.00 | ||

| 25 | 3 | Congre-gation | Offertory | 46.00 | 294.00 | ||

| 30 | 3 | Pastor Philip | Wages | 100.00 | 194.00 | ||

| 30 | 3 | Mary Banda (Youth worker) | Wages | 75.00 | 119.00 |